Job Costing Examples, Practical Problems, and Solutions

Someone on our team will connect you with a financial professional in our network holding the correct designation and expertise. Our team of reviewers are established professionals with decades of experience in areas of personal finance and hold many advanced degrees and certifications. The articles and research support materials available on this site are educational and are not intended to be investment or tax advice. All such information is provided solely for convenience purposes only and all users thereof should be guided accordingly. The company’s profit and loss during November will be affected by the choice of any method if all the jobs performed during the month are not completed by the end of the month. If the overtime premium is fully charged to Job No. 101, the job cost sheet would be prepared as shown below.

Which of these is most important for your financial advisor to have?

Finance Strategists is a leading financial education organization that connects people with financial professionals, priding itself on providing accurate and reliable financial information to millions of readers each year. A job cost sheet is prepared when the actual manufacturing costs are known. The information can be recorded in a job cost sheet which serves as a basis for charging stores, manufacturing, and administrative expenses to jobs. R Discuss the treatment of process loss and gains in cost accounting. R Discuss the various methods of valuation of work in process.

Get in Touch With a Financial Advisor

However, if the overtime work was due to limited production capacity and it was accidental that Job No. 101 was undertaken during the overtime, then the overtime premium should be charged pro-rata to all jobs. A financial professional will be in touch to help you shortly. Accurate cost allocation helps pinpoint areas for cost savings, thereby boosting profitability. Ask a question about your financial situation providing as much detail as possible.

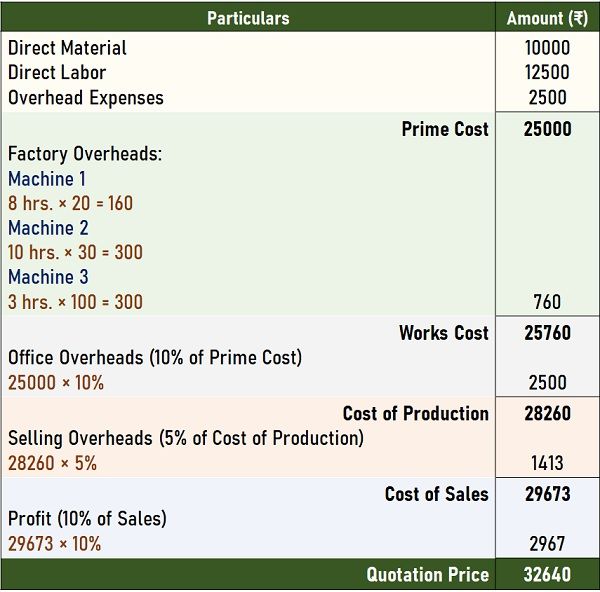

- The expenses shown below were incurred for a job during the year ended on 31 March 2019.

- 11 Financial may only transact business in those states in which it is registered, or qualifies for an exemption or exclusion from registration requirements.

- But, like all methodologies, it comes with its own set of challenges that require effective solutions.

- To better understand its application, let’s consider a hypothetical scenario.

- For businesses employing process costing, the products are often homogeneous, which means the products are identical or very alike.

Job Costing Examples, Practical Problems and Solutions

At its core, process costing is an accounting method tailored to the manufacturing industry. It plays a vital role in offering accurate cost insights, which in turn empowers businesses to make decisions about pricing, analyze profitability, and control costs, ensuring the organization’s financial well-being. Process costing and job costing are methodologies used to determine the cost of products.

Create a Free Account and Ask Any Financial Question

In this article, we’ll unravel the necessity of process costing, explore the obstacles it presents, and delve into strategies to overcome them, ensuring a streamlined and efficient costing system for businesses. In the competitive world of manufacturing, even minor errors in cost allocation can lead to mispriced products, thereby impacting profitability. It’s pivotal for businesses to have a clear understanding of resource utilization, product pricing, and potential areas for cost savings. Process costing aids in this by ensuring that costs are equitably distributed, painting a lucid picture of a firm’s financial status.

What are some advantages of job costing?

11 Financial is a registered investment adviser located in Lufkin, Texas. 11 Financial may only transact business in those states in which it is registered, or qualifies for an exemption or exclusion from registration requirements. 11 Financial’s website is limited to the dissemination of general information pertaining to its advisory services, together with access how do state and local sales taxes work to additional investment-related information, publications, and links. The job details shown below were taken from the costing books of a contractor for the month of December 2019. If the overtime premium is fully charged to Job No. 101 but is not completed by 30 November 2019, then the loss on the job will not be included in the account for November 2019.

During November 2019, the plant was operating at full capacity. The material and labor costs of Job No. 101 and all other jobs worked on in November are shown below. Helps in spotting cost trends, gauging production efficiency, and facilitating data-driven financial decisions.

Your information is kept secure and not shared unless you specify. Our mission is to empower readers with the most factual and reliable financial information possible to help them make informed decisions for their individual needs. At Finance Strategists, we partner with financial experts to ensure the accuracy of our financial content.

You are required to prepare the statement of standard cost and standard profit rate per75 litres of finished product. A financial professional will offer guidance based on the information provided and offer a no-obligation call to better understand your situation. This team of experts helps Finance Strategists maintain the highest level of accuracy and professionalism possible. For information pertaining to the registration status of 11 Financial, please contact the state securities regulators for those states in which 11 Financial maintains a registration filing. Similarly, if the overtime premium is charged pro-rata to all the jobs, the profit or loss on any job that remains incomplete will be carried over to the next month.

Process costing is more than just a technique; it functions as a valuable strategic tool, providing businesses with accurate cost data that can enhance profitability and competitiveness. It is essential for both large corporations and small businesses to consider adopting this approach to optimize costs, establish competitive pricing, and improve overall profitability. With over two decades of expertise in online bookkeeping services for small businesses, IBN Tech offers more than just conventional accounting software. It provides comprehensive oversight of your sales cycle, from inception to completion, and adeptly manages your inventory. By automating and optimizing process costings functions, IBN Tech not only curtails expenses but also allows your team to concentrate on other vital business facets, ultimately saving both time and resources.

In addition to these costs, factory overheads incurred in November amounted to $44,000. Overhead is allocated to production based on direct labor costs. Prepare the accounts in respect of the processes showing its cost and cost of production of finished product per unit.